Recent Articles

Popular Makes

Body Types

How Your Credit Score is Determined

How is your credit score determined? Your credit score has a huge impact on your life. A good credit score lets you buy clothes, food, furniture, gas, even homes and cars, based on your promise and ability to pay. Bad credit…well, let’s just say it’s the opposite. With credit so important, how is your car credit score determined?

A car credit score shows your credit history. Like taking the SAT, an auto credit score is also supposed to have predictive power about how you’ll pay your car loan in the future. The key things a potential creditor like a car dealership (and the manufacturer they represent) is looking for in your car credit score is your ability to pay, your stability, and your past credit history.

Your ability to pay is based on your income and expenses. If your income is $45,000, no matter what your car credit score, the dealer will be dubious about your ability to afford a $50,000 BMW. Your stability doesn’t refer to your mental state, but rather to your history. Have you moved six times in the last three years? Have you switched jobs twice in the last year or had long periods of unemployment?

Finally, and critically, the car credit score takes into account your past credit history. Do you have late or missed car payments? How many? Worse, do you have any charge-offs (where you owed money for an extended period of time and the creditor has given up on collecting it)? Any bankruptcies, judgments or other delinquencies will also affect your auto loan credit score.

It’s important to realize that a few blemishes on your credit score don’t mean you won’t get a loan, just as a few blemishes on your face don’t mean you won’t get a date. After all, the dealer is in business to sell cars, which means arranging financing. But just as blemishes may limit your dating universe, dings on your credit score may limit you to less desirable loans.

Your car loan credit score is based on what is called your FICO score. FICO stands for Fair Isaac Corporation, the company that developed the credit scoring methodology used today.

When you apply for a loan, a job, a credit card or to rent an apartment, your application is typically sent to one of the ‘big three’ reporting agencies, Experian, TransUnion and Equifax. They in turn sell the information in your report to creditors, employers, and other businesses that use the report to evaluate your credit applications. A finance manager at an auto dealership, for example, will use your car loan credit score to determine if they want to offer a loan, what terms and rates you’ll qualify for and how much they’ll let you borrow.

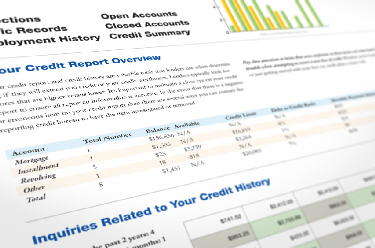

Your credit score, or FICO score, is a three-digit number that can range from 300 to 900. Most people score in the 500 (poor) to 800 (excellent credit) range. The credit score is calculated based on your credit history, your experience with creditors like banks, credit card companies, furniture stores and auto dealerships. A credit report is divided into identifying information (like name and social security number), credit history, public records (like bankruptcies, tax liens and judgments against you) and requests for your credit history.

If you read your credit report, you’ll see each listing notes whether it was installment credit, such as a car loan or mortgage, or revolving, like a credit card. Each item would also list when it was opened, how long the account has been reported, the high balance, and recent payment. A key line of a car credit report would list the status of the account, whether it was paid on time, never late, or past due by the number of days. Comments like “charged off” or “default” are particular red flags; they mean the creditor has made an effort to collect a debt and given up.

How is your credit score determined? Each credit reporting company uses slightly different versions of the scoring model, and some data may be reported to one company that’s not reported to another. That’s why before you shop for a car, you should get a copy of your credit report from each of the three and contact the companies to fix errors.

To make things a bit more complicated, when it comes to get auto financing, dealerships may use your regular FICO score, or more frequently, use a specific auto credit score, called the FICO Auto Industry Option credit score.

The bad news is that consumers do not have access to their Auto Enhanced Score. The good news is that you can get a pretty good sense of what your Auto Industry Option credit score will look like from your credit report. And the (potentially) better news is that even if you have a so-so standard FICO score, if your auto credit score is good you may still get a decent auto loan.

The Auto Enhanced FICO score essentially provides a dealership with a 3-digit number that rank orders risk of default for the next 24 months. If you’ve had previous car loans and have paid them promptly and in full (something you should be able to see on your regular credit reports) you will generally have a good Auto Enhanced FICO score. On the other hand, dings to your credit report for missing or late payments on installment loans for auto financing can tank your Auto Industry Option score.

How is your Auto Industry Option credit score determined? As you’ve guessed, this car credit score puts a lot more weight on how you handled previous auto credit. Late payments on a current or previous auto loan (or lease) will weigh against you. Other problems would be settling a loan for less than you owed, having an auto account sent to collections, and writing off your car loan in your bankruptcy. Repossession will also ding your auto credit score.

Such problems will affect your Auto Industry Option score more than your traditional FICO score. You’ll be perceived as a greater credit risk, meaning you’ll either be denied a loan or offered one with a high interest rate. On the other hand, even if you have other credit problems, if you never missed a car payment, your auto loan credit score will probably be better than your standard FICO.

This means the dealership may be able to offer you a decent car loan rate. However, as the Auto Industry Option score isn’t available to consumers. They don’t have to even tell you the good news. That shouldn’t stop you from asking what your car credit score is, or if it’s better than your FICO.

So when you’re ready to talk turkey with the dealer, keep your regular FICO scores in your back pocket. If the dealership pulls your car loan credit scores and they’re better than what you have, go with it. If yours are higher, show your cards; dealers often can choose which credit score they can take to give you a better rate.

If you don’t like the answers you get from the dealer, or feel he’s trying to get you financed at a higher rate based on your lower standard FICO score, you can always look for a better deal elsewhere.