Recent Articles

Popular Makes

Body Types

How Does the Electric Car Tax Credit Work?

hero EVgo ・ Photo by EVgo

The obvious price is often not the real price when it’s time to buy a battery-electric vehicle (BEV.) The Manufacturers Suggested Retail Price (MSRP) shown on the Monroney sticker on the window of that new BEV on the showroom floor does not represent your true gross price once you factor in state and Federal involvement in the net price – that is, your price after all credits and deductions.

Like most financial transactions, buying a BEV is more complicated than it seems like it should be. That’s why we’ve put together this short primer that answers the question: How does the Electric Car Tax Credit work?

Federal Tax Credit

The United States government (through the Internal Revenue Service) currently offers a tax credit for qualified plug-in electric drive motor vehicles. This credit, up to $7,500, is applied to income tax for taxpayers who buy a new two-wheel or four-wheel plug-in electric vehicle with a gross vehicle weight of fewer than 14,000 lbs.

The vehicle manufacturer informs the taxpayer at the time of purchase how much credit the BEV qualifies for, and the purchaser claims that amount on IRS Form 8936 as part of their annual tax return. The credit is applied against any tax liability for the purchasing year.

State Tax Credits, Rebates and Incentives

On top of the Federal tax credit, 13 states currently offer tax credits, rebates, and incentives of up to $5,000. If you live in Arizona, California, Connecticut, Colorado, Delaware, Louisiana, Maryland, Massachusetts, Nevada, New Jersey, New York, Oregon, Pennsylvania, Washington, or Washington, DC, your state government has a program to provide benefits for purchasing a new BEV. California, Colorado, Massachusetts, and Tennessee extend benefits to taxpayers who lease a new BEV too. Some states provide a rebate that is paid upon purchase, some offer a tax credit that is applied to annual filing, some offer tax-free purchase, some offer carpool lane access and some offer reduced electric rates. Check with your state tax office for details.

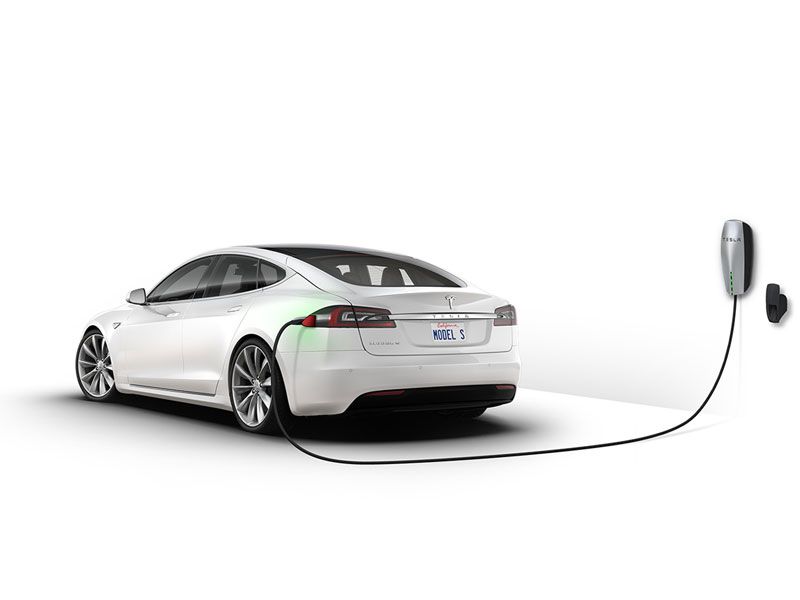

Photo by Tesla

What’s the difference between a credit and a deduction?

A tax credit reduces your total tax bill. For example, if your Federal tax return showed an income of $100,000 and a tax rate of 10 percent, you would owe $10,000 in taxes. A $7,500 tax credit would reduce your total tax bill for the year to $2,500.

If you received a tax deduction of $7,500 on that same $100,000 of income with a tax rate of 10 percent, you would owe $9,250 in taxes after the deduction. In this situation, a credit is better than a deduction for your bottom line.

Photo by General Motors

How long will It last?

There’s no telling how long Federal tax credits or State incentives will last. That’s up to Congress and State governments. For now, expect benefits to be available through the 2018 tax year. Individual manufacturers’ vehicles eligibility for Federal tax credits only apply until the manufacturer has delivered 200,000 BEV units for distribution in the U.S. After that, the credit phases out for that manufacturer in the form of 50% for two quarters, 25% for an additional two quarters, and no credit thereafter.

Federal Credits for Charging Stations

The Federal government did offer a tax credit for the installation of a charging station for individual taxpayers, the smaller of 30% or $1,000, and up to $30,000 for businesses. Unfortunately, this credit expired December 31, 2016, and has not been renewed. If you installed a qualifying charger before the credit expired but didn’t apply for it, you may be entitled to carry over the credit on your taxes. Talk to your accountant to see if this applies to your previous year's taxes.

State Credits, Deductions, and Rebates for Charging Stations

Several states still have tax credits, deductions, and rebates in place for taxpayers and businesses who install qualifying charging stations. These range from a $75 credit to individuals in Arizona, to a 15% (up to $75,000) rebate on guaranteed energy loans from the state of California to business owners who install a qualified charging station. Check with your state income tax office and with your accountant to see if you qualify.

Photo by Chargepoint

Other Incentives

Some states with high-occupancy vehicle (HOV) or carpool lanes allow BEVs to use the service even without a passenger onboard. Other states offer reduced vehicle registration fees for BEVs, while a few offer free or reduced rate parking in government parking lots. There are still some free charging stations at state offices, as well as charging station requirements for new commercial and multiple-occupancy residential buildings.

Photo by Wikimedia Commons

Energy Company Programs

Public and private energy suppliers have a vested interest in the expansion of BEV use, and many have programs to encourage and incentivize the installation and use of charging stations at homes and businesses. Though these are not tax programs, they can help offset the cost of purchase and installation and may offer lower rates for the kilowatts you use to charge your BEV. These programs can also help you to track your BEV usage, which will make it easier to calculate any applicable tax deductions next April 15.

Photo by Southern California Edison