Recent Articles

Popular Makes

Body Types

10 Things to Do if You've Just Purchased a New Car

2020 Audi A5 Sportback ・ Photo by Audi

Buying a new car can take a lot of effort, so it is natural to want to relax and exhale after you complete the process. But if you do, you won’t get the most out of that expenditure, and you could even be opening yourself up for problems.

Instead of slumping in your easy chair, it is sensible to go through a checklist of things you should do immediately after buying a new car. Completing these simple tasks will ensure that you take advantage of every feature that your new vehicle offers you. And it will also ensure that you don’t fail to do something that could make owning the car even easier. Some of these tasks can even save you money. So here are 10 things to do if you’ve just purchased a new car.

1. Have the dealership perform a delivery.

When you have completed the paperwork and signed on the bottom line for your new car, your first inclination might be to get out of the dealership as soon as you can. But if you rush through the delivery process — or skip it altogether — you will be missing a golden opportunity to learn more about your new vehicle and to set it up the way you want it. In the long run, that will save you both time and headaches.

With the help of dealership personnel, you can learn how the systems and features of your new car operate. They can assist you in pairing your phone to the infotainment system, set up the memory function for your seats and accessories, and explain how to activate equipment like adaptive cruise control that might be new to you. In retrospect, you will find that this “set-up” time will be minutes well-spent.

Photo by iStock Photo

2. Get to know the service department.

Probably the last thing on your mind when you purchase a new car is vehicle service. You might have purchased a new car because your old one was always in the shop. But on the day you buy your new car, you should take advantage of the opportunity to get to know the service department at the dealership where you bought the car.

You are almost certain to have maintenance and repairs performed there during the first several years of your vehicle ownership. Any new vehicle you purchase will have warranty coverage, and to use that coverage, you are well-advised to use the service department at the dealership where you purchased the car. Getting to know the service manager and a service writer at the dealership can help grease the wheels when you return.

Photo by Adobe Stock

3. Consult the manual.

The delivery walk-around and explanation process can go a long way toward helping you understand the nuances of your new car. That said, it won’t cover everything. That’s why having a sense of what’s in the vehicle's owner's manual is such a valuable piece of knowledge.

The owner’s manual will help you understand how systems like infotainment, safety, and driver's assistance work. You will also find a maintenance schedule for your car that will suggest how often you should have important maintenance items performed. Finally, it will give you emergency numbers to call if you have issues. We don’t recommend you read the whole manual from cover to cover in one sitting. But spending some time with it can be a very worthwhile experience, especially if it reveals a feature you never knew about.

Photo by Stephen Davies - stock.adobe.com

4. Insure the car.

One of the first things you might have done — or maybe should have done — is arrange vehicle insurance for your new car. At the same time, you might have canceled the insurance coverage on your previous car.

Car insurance not only protects you financially, but you likely need to have insurance on the car before it can be registered and licensed. Many states require you to provide them with proof of insurance before they will register the vehicle, and many dealers won’t allow an uninsured vehicle to drive off their premises. The requirements differ by state, but an online search and/or your insurance agent can steer you in the right direction. A state’s minimum insurance requirements might well be too low to protect you and your assets adequately, so keep that in mind when you sign up for your insurance.

Photo by Adobe Stock

5. Check on your other insurance.

Since you are buying a new vehicle, you will have to change your car insurance coverage. That’s a given. It also is a great opportunity to review all your insurance coverage. Likely you have homeowner’s or renter’s insurance coverage. You might also have insurance on a boat, personal watercraft, or motorcycle. You might even have insurance on an electric bicycle.

With that in mind, it could be to your financial advantage to consolidate all that coverage with one insurance carrier. Often called “bundling,” this could result in significant savings on your overall premiums. Checking with your current insurance broker is a good place to start. Or you could seek online quotes from several insurance companies. You might save hundreds of dollars a year for similar coverage.

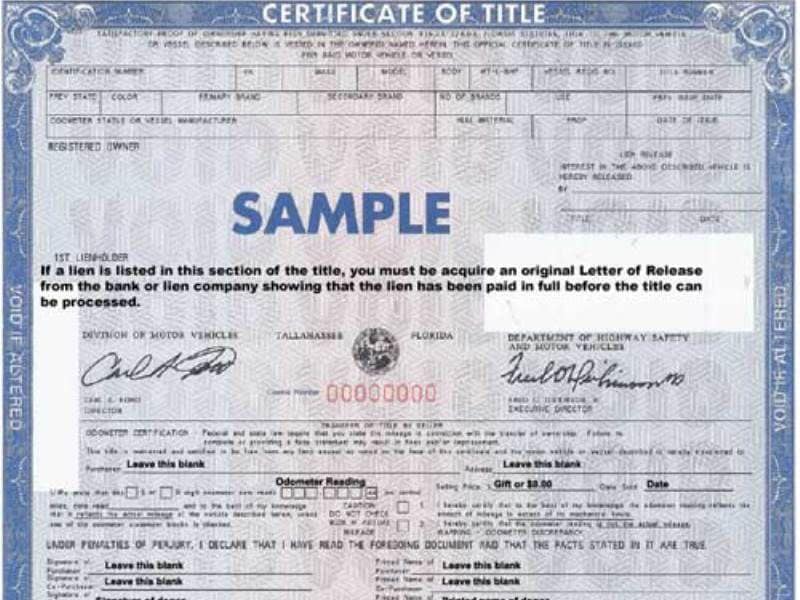

6. Get the title transfer done right.

The vehicle title is an official document that establishes ownership of an individual vehicle. When you purchase a new car outright, the title of the car should be transferred from the seller to you, the buyer. If you make the purchase of the new vehicle with a car loan, the financial institution that made you the loan typically holds the car’s title even though you insure and license it.

The dealer who is selling you the car will perform most of the title transfer process for you. It will require some information from you to accomplish this. This info could include your address, Social Security number, and/or driver’s license number. It might also include the name and contact information of your auto insurance company. It is critical that the dealership get this information accurately. As you review your new-car paperwork, make certain this information is correctly recorded.

7. Make certain the car is registered and licensed.

Since you purchased your new car from a dealer, the dealership will usually do most of the legwork on car registration. To register the vehicle properly, the dealer has to establish your identity, know where you reside, and often obtain proof of insurance. The dealer will also collect state and local sales tax on the transaction and other local fees.

At the same time, depending upon the procedures in your state, you will typically be issued a temporary registration and/or temporary tags (“paper plates”) that must be affixed to your new vehicle. Once the vehicle is registered and the fees are paid, your permanent license plates (tags) will soon be on the way to you.

Photo by Seventyfour - stock.adobe.com

8. Budget your loan payments.

The majority of new-car buyers use a car loan to help finance the purchase of the vehicle. Financial experts estimate that as many as 75 percent of all new-car purchases involve some sort of consumer financing. Now that you have purchased the car, it is important for your financial future that you make your monthly payments on time and in full.

Skipping a payment, even inadvertently, can cause a problem. Missing several payments will likely cost you the car and all the money you have paid on it to that date, and mess up your credit on top of it. You want to avoid all that. How? You need to budget your finances so you won't have any problem paying the required amount each month. Doing this diligently will pay off by building your overall credit rating.

Photo by Adobe Stock

9. Set up your loan payment schedule.

Most new-car buyers have good credit ratings. But even people with good credit can occasionally miss car payments. While it might seem like a little thing if your payment is late, the fact is it can negatively affect your credit rating. And that can cost you money in the long run by making the next loan more expensive.

There are several ways to ensure you make your car payment on time. You can schedule writing a check and mailing it to your lender in a timely fashion each month. Or you can schedule online or mobile bill payments with your bank or credit union. A service like that lets you pre-approve payments to the lender from your financial institution each month. Another option is to give the lender permission to withdraw scheduled payments from your bank account on a recurring basis. Some lenders will offer a discount on your monthly payments if you authorize this. The downside is the money might come out of your bank account at an inopportune time.

Photo by Adobe Stock

10. Save your paperwork.

It doesn’t make much sense to do all the things we outlined here without keeping records of what you’ve done. Further, the paperwork surrounding a vehicle purchase — things like title, registration, and insurance policies — are important documents. You might not think you need them, but there will almost undoubtedly come a time when they are very important. So collect them and save them in a safe place.

If you have purchased the car outright you should have the vehicle title plus the bill of sale. You also should have the documents associated with your vehicle loan. Perhaps you have a fireproof safe in your house, or you keep important documents in a safe deposit box at your local bank. However you go about doing it, you are doing yourself a big favor if you keep your car documents in a secure place, a place you will remember. It will save you headaches later.

Photo by Adobe Stock