Recent Articles

Popular Makes

Body Types

Automotive Financing and the Pursuit of Happiness

90 years ago we gave up everything for our inalienable right of automotive ownership

During the early 1920s many new high-tech goods were introduced in America, including the automobile and radio. The automobile, unlike the radio, brought a unique consumer challenge - How would the average person afford one?

It was for this reason automotive financing was born.

Today, buying things on credit has become routine in America, from computers to luxury cars, financing is how many Americans purchase things.

To better understand the history of automotive financing I turned to the Library of Congress and their massive collection of historical documents. In my research I came across an interesting bit of correspondence between L.Q. White, a Boston bank owner; Everett Sanders, the Secretary to the President of the United States; and D.R. Crissinger, Governor of the Federal Reserve.

Mr. White wrote to the White House to share his opinion that automotive lending was bad for America, believing automotive loans would burden consumers with monthly payments and reduce their ability to purchase other items, thereby impairing many other industries. Mr. White also believed that, contrary to law and policy then, many of the loans that had originated at local dealers were being purchased by corporations, bundled and then guaranteed by the Federal Reserve.

Excerpts from Mr White’s letter:

“My impression is on account of the tremendous loans that ever bank all over the country is extending to buyers of automobiles, that such loans are handicapping every other industry. The buyer of even the cheapest automobile obligates himself, for instance, to pay twelve notes maturing a month apart, $15 a month besides making an initial payment of perhaps $25 or $50 on a low priced car.”

“It seems to me that no industry should be allowed to employ excessive amounts of money thru the Federal Reserve by taking on this tremendous amount of small loans, which seems to be the manner of buying automobiles today. The very fact that the workman perhaps earning $20 to $25 a week is handicapped by having these payments to meet each month, certainly means a hardship for every other industry, and in time, would bring nothing but disaster to the automobile business as well as all other businesses.”

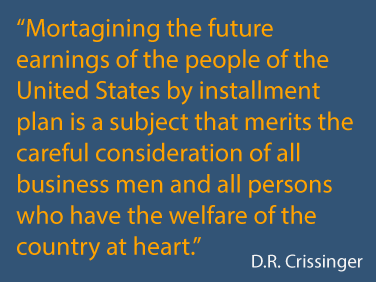

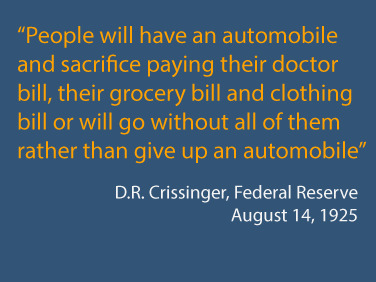

D.R. Crissinger, the Governor of the Federal Reserve, wrote in response:

“Discount companies find it extremely profitable because they have learned that the family will sacrifice other convenience, every other luxury and often necessities rather than give up the automobile. This makes of course the assurance of payments to discount corporations that handle the paper at a large discount from the selling of automobiles and the security is reasonably safe because the vendors of the automobile guarantee the loan in addition to his intense spirit to pay on the part of the buyer.”

This wasn’t the only time the Federal Reserve addressed automotive lending in the 1920s.

Automotive Financing and the Pursuit of Happiness

The Willmar Tribune published a column on July 28, 1920 regarding a warning issued by the Federal Reserve to all banks: “

The column went on to describe the challenges lenders would have in determining the difference between using an automobile for business and for pleasure.

The column closes by making a decree that vehicle ownership was a right reflected in the Declaration of Independence:

“The "pursuit of happiness' is one of the inalienable right that was woven into the Declaration of Independence and even tho it may appear to some of us that a man engage in this pursuit foolishly, yet so long as he remains within the law, pays his debts, and harms no one, his conduct should be free from the restricted action of the Federal Board and all other Governmental agencies. This is Democracy.”

The American dream had been born. And that dream was to own an automobile.

In a 2008 letter to the Security and Exchange Commission, a collection of automotive finance companies argued against a proposed federal rule that would have made 60 months the maximum term for an automotive loan. The group said “[that the] 72 month term has become the industry standard,” and that it was critical to the American economy to allow banks to determine independently the risk as it relates to automotive loans. They argued that any mandated term limit would cripple the automotive industry. They were probably right.

It’s estimated this year automakers will sell 15 million vehicles, and while the price of automobiles continue to increase, the total monthly payment has gone down. This lower monthly payment is a result of leases and longer financing terms. According to Experian the average new car loan is 64 months and 27.5% of all new car purchases are leases, the highest level of leases since 2006.

As the cost of automobiles increase, the purchasing options available to buyers evolve in a manner to ensure a minimal impact on their monthly payments. A consistent monthly payment gives buyers comfort knowing their level of disposable income is preserved.

Innovative financing, good or bad, is what allows many Americans to buy new cars.

These letters show us that ninety years-ago there was a concern Americans were making misguided financial decisions to purchase an automobile -- the status symbol of that era.

Are we facing a similar situation today?

Are Americans making misguided financial decisions (i.e. 84 month automotive loans) to be able to purchase a status symbol of this era? Is that status symbol still the automobile? Or has something replaced the automobile as the thing Americans would sacrifice food, clothing and health to have?